Are Retail Media Budgets Doomed? How Brands Should Rethink Retail Media Strategies in the Face of Tariffs and Economic Uncertainty

By Shaun Brown

As the landscape of commerce media evolves rapidly, brands are now confronting a new wave of uncertainty: increasing tariffs, rising costs, and a macroeconomic environment full of question marks. For those selling across Amazon, Walmart, Instacart, and other top retailer marketplaces, the pressure is mounting to justify every dollar spent, all while continuing to drive growth in an increasingly competitive digital shelf.

In times like these, it's not just about spending smarter — it’s about planning with resilience, adaptability, and precision. Retail media and commerce media continue to be non-negotiable levers for visibility and sales velocity, but the way brands activate and allocate budgets must shift with the climate.

Let’s explore the strategic mindset brands should adopt right now, including five mission-critical priorities, and what lessons we can pull from past periods of disruption—like the COVID-19 pandemic—where brands managed to survive and even thrive through savvy retail media strategy.

The Current Climate: Why a Strategic Shift Is Necessary

With tariffs on Chinese imports potentially rising from 25% to as high as 100% on key product categories, brands are facing serious cost pressures. Coupled with inflation concerns and ongoing supply chain challenges, this environment is forcing leadership teams to reassess their margin structure and go-to-market strategy.

However, consumers are still shopping — and increasingly so online. Amazon, Walmart.com, Instacart, and Target.com continue to see strong digital engagement, especially in categories like grocery, household essentials, and everyday convenience.

This is where retail media plays a critical role. It's no longer a "nice to have" — it's a survival tool. But it must be wielded with smarter segmentation, sharper ROI measurement, and agility baked into every campaign.

Why Should You Be Paying Attention?

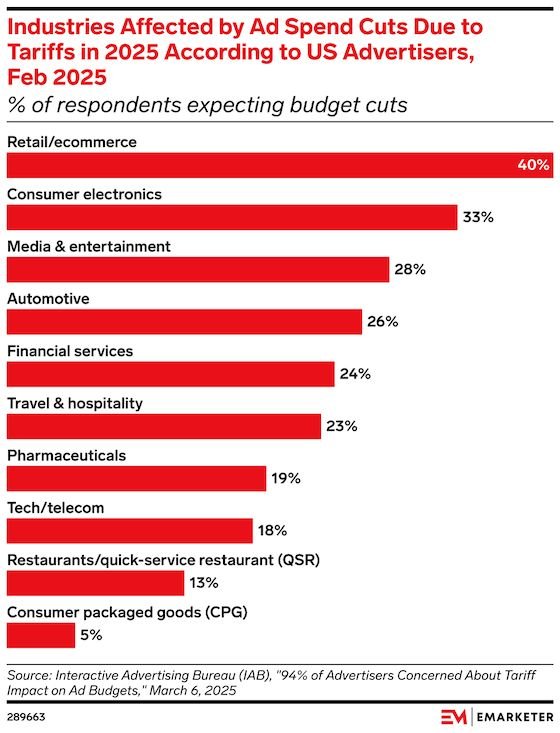

Most advertisers believe that retail and ecommerce will be the most affected by any economic uncertainty…but is that what history tells us?

Top 5 Priorities for Brands Right Now

Here’s what brands should be focused on in the second half of 2025 as they navigate these headwinds:

1. Prioritize High-ROI Retail Media Channels

When budgets are under scrutiny, you need to get laser-focused on where dollars drive the most incremental value. That means aligning closely with bottom-funnel, conversion-oriented media — particularly on Amazon and Walmart Connect.

Amazon Sponsored Products and Sponsored Brands remain the best-performing levers for most brands. Brands should consider leaning into product-level profitability data and Amazon Marketing Cloud (AMC) insights to prune non-performers and reallocate budget to the top 20% of ASINs driving 80% of revenue.

Walmart Connect’s Search and Onsite Display offers similar performance-focused tools. Use Search Brand Amplifier (SBA) to capture top-of-search real estate for your most profitable SKUs.

Now is not the time to experiment with unproven awareness tactics unless they’re part of a broader, performance-driven full-funnel approach.

2. Focus on Operational Efficiency and Margin Intelligence

You can’t afford to promote unprofitable products. That means brands need to pull together data from retail media platforms, 3P tools, and their own internal margin models to create profit-based media planning frameworks.

Consider:

Cost-to-serve metrics on each retailer.com (including fulfillment, advertising, and returns).

Tariff-influenced margin recalculations for imported goods.

Automated rules-based bidding to reduce spend on low-margin or tariff-heavy SKUs.

Some brands are even using tiered activation models: Green-lighting full-funnel media only on profitable products, and limiting others to organic sales support or seasonal clearance pushes.

3. Invest in First-Party Data and Measurement

Retailers are pushing deeper into their own walled gardens — and with that comes more sophisticated targeting and measurement. Now is the time to invest in retailer-specific audience segmentation and closed-loop attribution.

On Amazon, use AMC and Amazon DSP audiences to identify high-value repeat customers or category switchers you can conquest.

On Walmart, lean into Luminate insights to inform targeting strategies and justify spend allocation.

On Instacart, segment shoppers by order frequency and basket composition using their evolving audience tools.

Better targeting = less waste = more sustainable ROAS in uncertain times.

4. Diversify Your Marketplace Presence Strategically

One common mistake brands make during turbulent times is over-consolidating. While it’s smart to cut underperforming channels, diversification across high-traffic platforms can de-risk your business.

If you’re all-in on Amazon, now may be the time to pilot programs on Instacart, Target Roundel, or Kroger Precision Marketing (KPM) — especially if you sell consumables or CPG. These platforms offer closed-loop attribution, retailer-owned data, and high-intent shopper bases.

But remember: don’t diversify just to diversify. Choose platforms where your category is actively searched, and where media and retail execution can align for growth.

5. Plan for Agility: Monthly Reviews, Not Quarterly Plans

Rigid quarterly planning doesn’t work in volatile conditions. Brands should be reviewing retail media performance monthly, if not bi-weekly, to reallocate budgets, shift bids, and activate timely creative based on real-world dynamics.

Tariffs might change mid-year. Inflation could spike or cool. Retailer algorithms will evolve. Being agile means:

Having contingency budgets you can deploy quickly.

Flexible creative pipelines for fast-turn campaigns.

Media playbooks that allow you to shift from brand to performance tactics depending on real-time consumer behavior.

If the last five years have taught us anything, it's that agility is the most valuable muscle a brand can build.

What We Learned From the Pandemic

Looking back at the early days of the COVID-19 pandemic, we saw remarkable examples of brand survival through smart commerce media tactics. Here are a few standout plays:

1. Agile Budget Shifts

When stores closed and demand shifted online, CPG brands like Clorox and P&G quickly shifted budgets from linear TV to Amazon and Walmart Connect to stay in front of their core shoppers. Many used sponsored search and retail DSP to capture demand surges.

2. Prioritizing Availability

Brands that aligned media to in-stock products won. Unilever, for example, used API-based integrations to turn off ad campaigns for out-of-stock items and redirect spend to fast-replenishing SKUs. This tactic ensured they weren’t wasting spend or frustrating customers.

3. Investing in DTC and Marketplace Mix

During the pandemic, even legacy brands began to invest more in marketplaces like Amazon and Instacart due to the last-mile delivery infrastructure and shopper trust. Those that diversified early avoided sole dependency on volatile DTC channels and created more balanced revenue streams.

4. Leveraging Retailer-Owned Data

Brands that partnered closely with retailers to use shopper data for targeting saw better performance and faster learning cycles. Kroger, Walmart, and Amazon were all praised for their collaborative insights with brand teams during this time.

These lessons are just as relevant now. In uncertain times, the brands that act fast, stay close to consumer behavior, and lean into commerce data outperform those who retreat or freeze.

Final Thought: Pressure Breeds Clarity

While economic turbulence is difficult, it also creates clarity. It forces brands to double down on what works, trim the fat, and build processes that are sustainable, efficient, and performance-oriented.

Retail media is not just a lever for growth — it’s now a lever for survival, margin protection, and long-term brand health. As we look ahead to the back half of 2025 and beyond, the brands that adapt will be the ones still standing — and winning — in 2026.

In Summary: The 5 Things to Get Right

Prioritize performance-driven media (search, onsite, DSP) across Amazon, Walmart, Instacart.

Tie media activation to product-level profitability, especially with new tariffs in play.

Invest in first-party audience targeting and retailer measurement tools.

Diversify marketplace presence, but only where it aligns with category and capabilities.

Adopt agile planning with fast-turn campaign reviews and flexible budgets.

Need help navigating these challenges? Whether you're scaling on Amazon, entering Walmart, or looking to optimize your retail media ROI, our team at BirdDog is here to help you cut through the noise and activate smarter.

Let’s build a retail media plan that works for this economy — and the next.